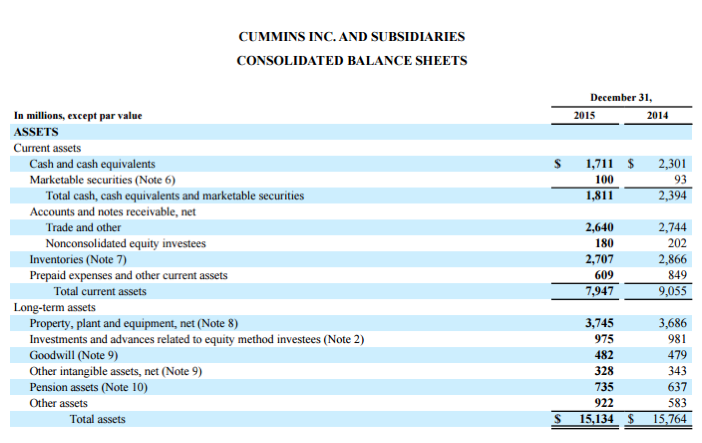

Solved] Land P 800,000 Building Pl,500,000 Less: Accumulated depreciation 450,000 1,050,000 Equipment P 700,000 Less: | Course Hero

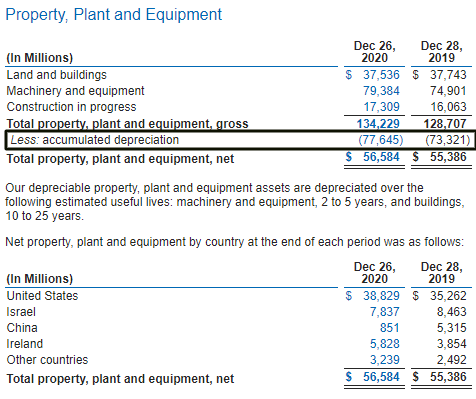

Nike, Inc.reported the following plant assets and intangible assets for the year ended May 31, 2022 - Brainly.com

Solved] Land P 800,000 Building Pl,500,000 Less: Accumulated depreciation 450,000 1,050,000 Equipment P 700,000 Less: | Course Hero

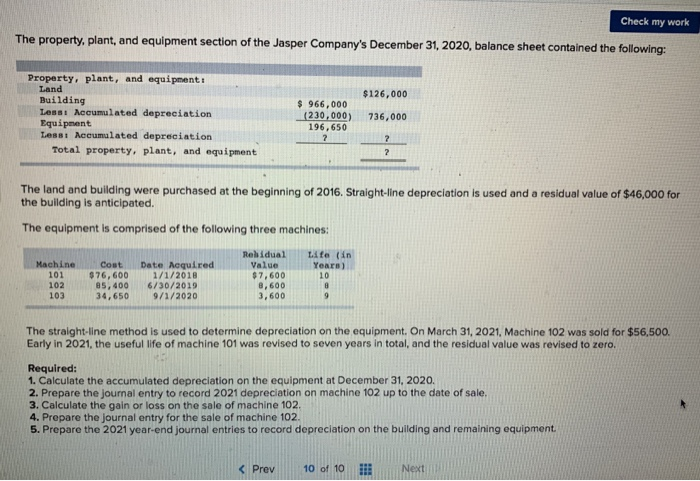

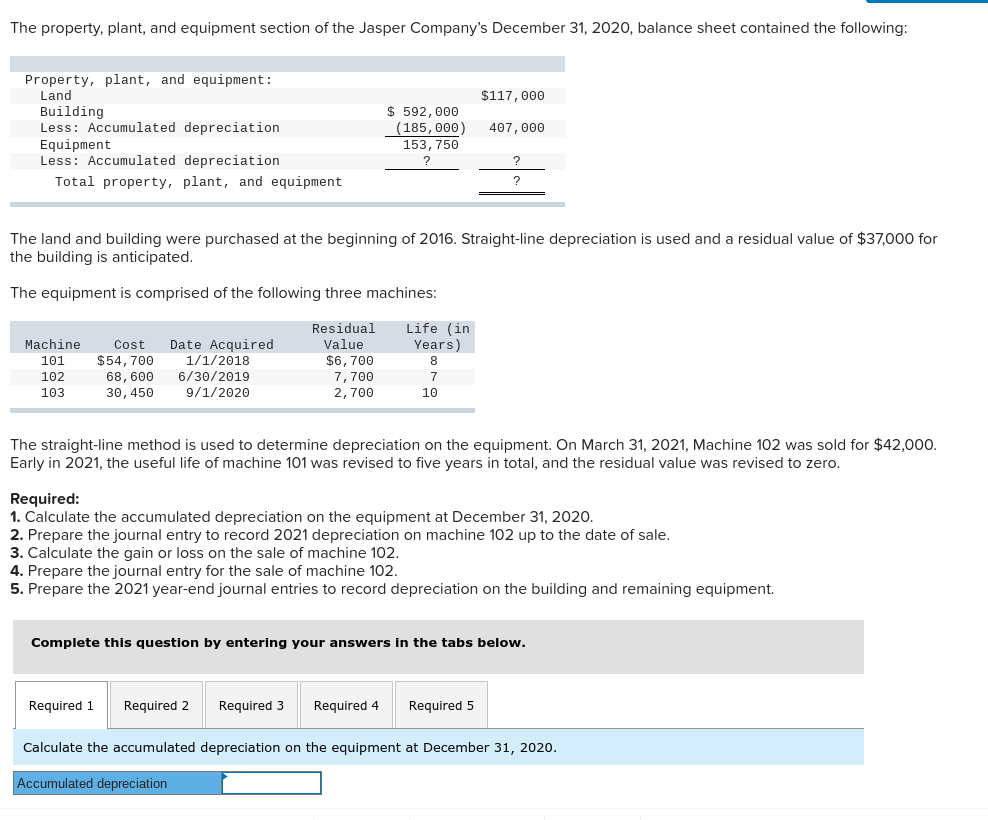

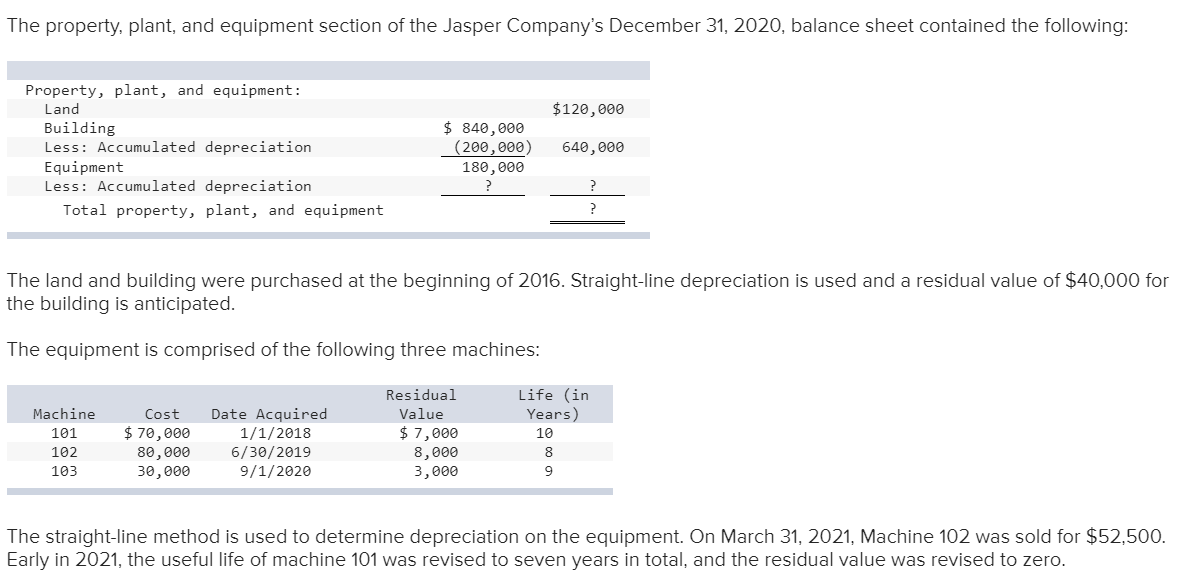

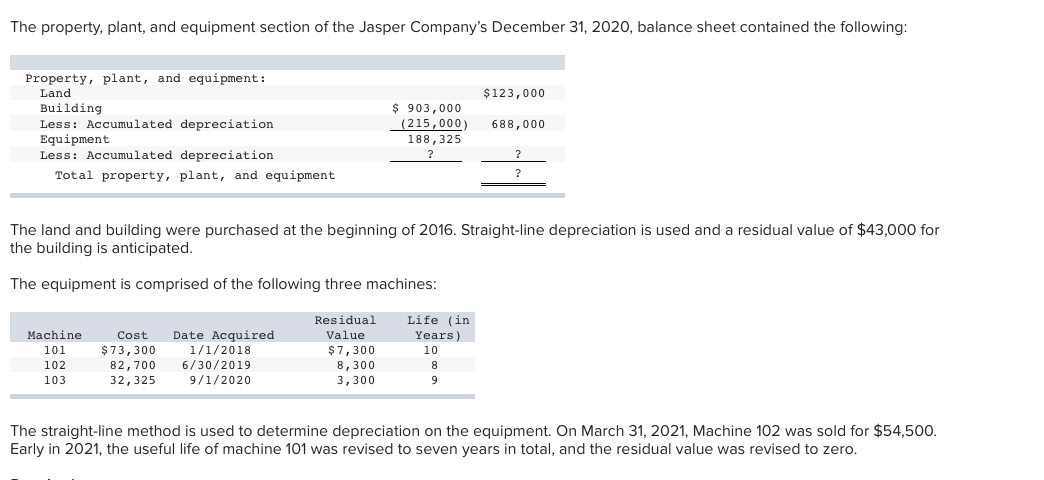

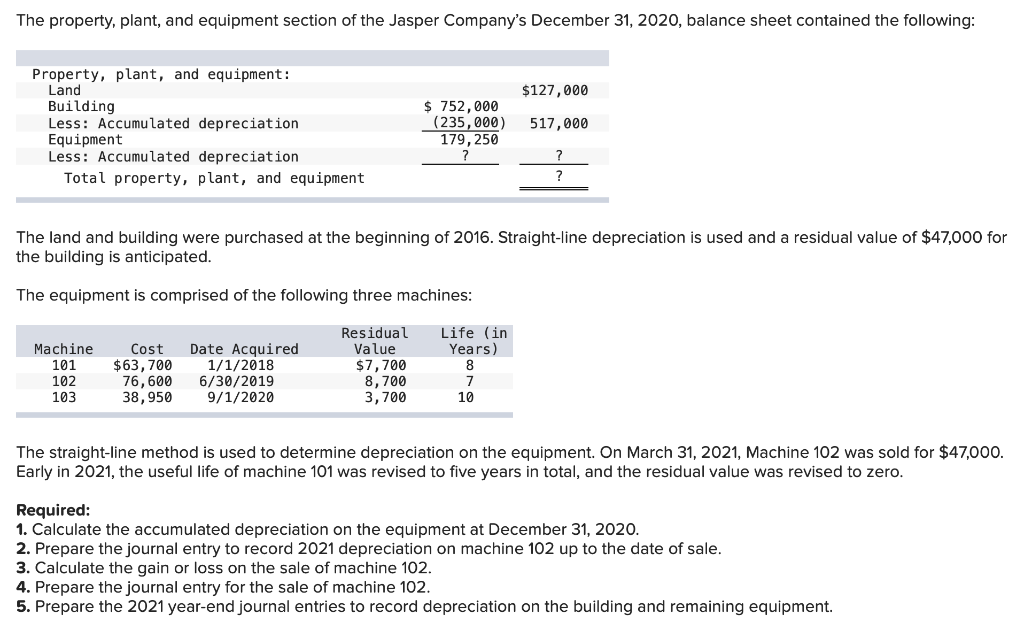

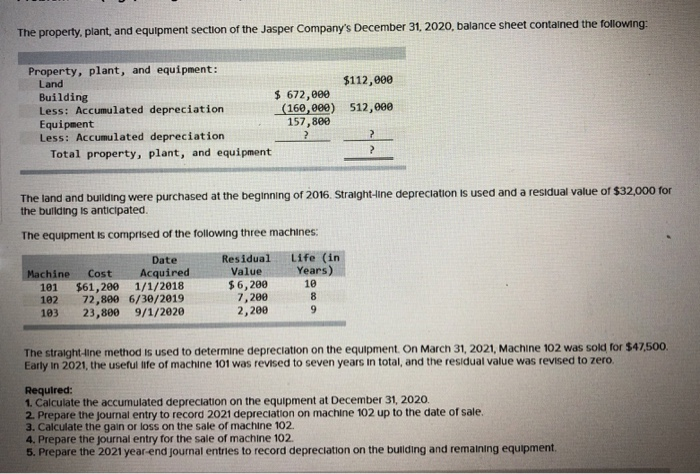

The property, plant, and equipment section of the Jasper Company's December 31, 2020, balance sheet - Brainly.com

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

![Solved] 1. Calculate and record depreciation for the year ended December 31, 2 | SolutionInn Solved] 1. Calculate and record depreciation for the year ended December 31, 2 | SolutionInn](https://www.solutioninn.com/images/question_images/1576/0/6/2/3035df0cd5f756541576045807758.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)